The GSTN has released module-by-module new functionalities for taxpayers to use on the GST portal. This is a register of food issues the ATO has determined.

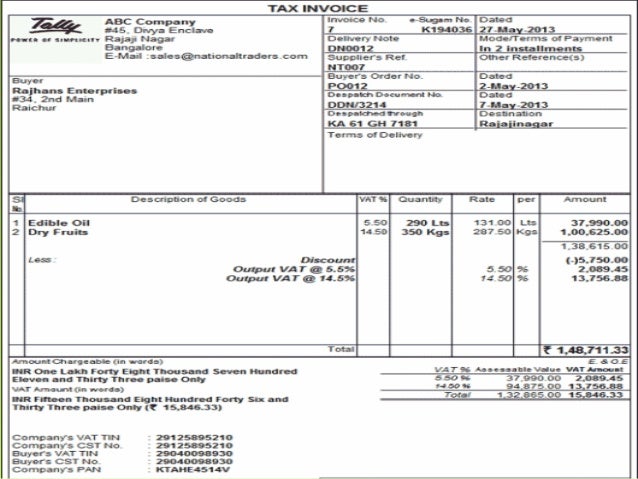

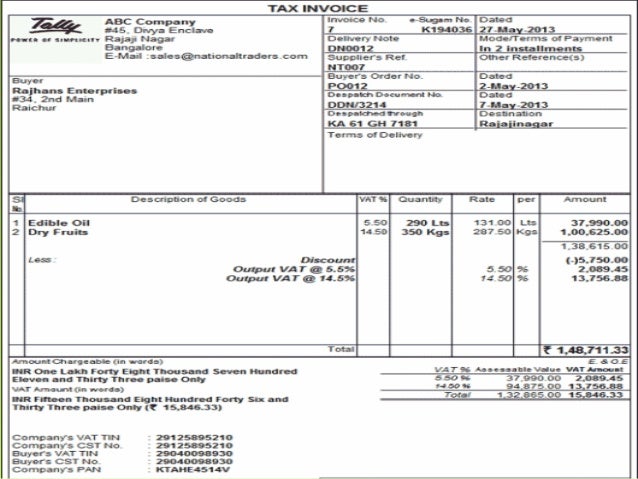

Gst Invoice Format Rules Download Sample Tax Invoice Indiafilings

For purchases in foreign currency the Singapore dollar equivalent amounts are not shown.

. Unlike normal transactions you should not issue a tax invoice to the recipient of the gift. Application Form For Advance Ruling. To access your previous 13 months of bills select View previous bills.

E-invoicing in India went LIVE for B2B transactions from 1st October 2020. Division 156 - supplies and acquisitions made on a progressive or periodic basis. Various new functionalities for GST stakeholders are introduced on the GST portal from time to time.

These features apply to a variety of modules including Registration Returns Advance Ruling Payment Refund and other topics. Non-payment of service tax - manpower supply service - differences in the figures reflected in ST-3 Returns and in form 26AS - form 26AS is not a statutory document for determining the taxable turnover under the Service Tax as form 26AS is maintained on cashreceipt basis by the Income Tax department for the purpose of TDS etc. Supplier is not GST-registered.

The concept of Goods and Service Tax GST was made applicable in India on 1st July 2017. Join our GST training session online class certification course and get trained on how to apply for a GST certificate create GST invoice claim ITC and file GST returns. Grievance is submitted successfully.

CAs experts and businesses can get GST ready with Clear GST software certification course. Attributing GST payable or an input tax credit arising from a sale of land under a standard land contract. You will receive an Acknowledgement with Grievance Number in next 10 minutes on your Email ID.

Site best viewed at 1024 x 768 resolution in Microsoft Edge Google Chrome 49 Firefox 45 and Safari 6. The Goods and Service Tax GST Council has recommended hiking the GST rates on. The suppliers name address and GST registration number are not shown.

Missing details on the tax invoice. This would not lead to a conclusion that the application of Rules 117 and 120A cannot be harmonized to make them workable viable and. Corporate card statements - entitlement to an input tax credit without a tax invoice GST Ruling.

And c supplies the service to a body corporate. The same will be introduced subsequently for all the taxpayers. With the implementation of E-invoice generation the GST system shall be able to validate all the.

One having a tax invoice. Any system verifies the authenticity of an invoice by using this unique number as reference. Is a mechanism being introduced to curb tax evasion and enable an invoicing standard in India.

Our Goods Services Tax course includes tutorial videos guides and expert assistance to help you in mastering Goods and Services Tax. A supplier cannot take Input Tax Credit of GST paid on goods or services used to make supplies on which the recipient is liable to pay tax under reverse charge. Go to Payments at the top of the screenA list of your billing accounts will be displayed select Download PDF bill on the relevant account.

IRN is generated by the e-invoice system after a business taxpayer uploads their invoice details or gets it done via a GSP. The recipient will be able to claim the GST paid as its input tax if it can satisfy the conditions for input tax claim. Service tax accumulated till June 30 2017 before the new goods and services tax GST was put in place.

GST is a tax levied for the consumption of goods and services. Transitional credit - Seeking direction to credit the amount relating to input tax credit ITC - Rule 120A does not by itself stipulate any time limit though undoubtedly the timeline stated under Rule 117 has to be read into Rule 120 as well. Enter the GSTIN mentioned on the invoice in the search box and followed by captcha Final click enter to view the details.

GST e-Invoice - Resources Ease of Doing Business e-Despatche-Space News and Press Release Clarification on GST applicability of GST on. Have the recipient of the gift pay the output GST. Not to serve the notice period while leaving their current job as per a report issued by the Authority of Advance Ruling AAR.

Right To Serviceसव क अधकर Auction Who is Who Webinar on e-invoice Download list of taxpayers eligible for e-invoice From 20th April 2018 in Uttarakhand State it is mandatory to generate e-way bill for intra-state movement of taxable goods of value above Rs 50000-. FORM GST ARA -01. The GST council of members has held several rounds of meetings to revise GST rates.

Click on the link to view the issue of interest to you. Authorization For Inspection Or Search. Our GST Software helps CAs tax experts business to manage returns invoices in an easy manner.

Generation of Invoice Reference Number. The latest GST rates show a reduction of 6 to 18 in GST rates for various commodities across most categories. The recipient of the gift cannot claim the GST as its input tax.

However many aspects remained unresolved and petitioners moved to court filing reaching the high court seeking to scrap Rule 117 of CGST Rules 2017 which provides a time limit to carry forward tax credit. B does not issue an invoice charging GST 12 from the service recipient. Course contains E-Learning class with downloadable video lectures E-Books and course completion certificate on Goods and Service Tax of India.

Advance Ruling Forms in GST. Every IRN is unique in the GST system irrespective of the taxpayer financial year and document type. For purchases S1000 the words tax invoice name of customer or GST amount is not shown.

The tax is applied by the supplier of products and services while billing customers. Input Tax Credit under RCM. For GST Luxury Car Tax and Wine Equalisation Tax purposes from 1 July 2015 where the term Australia is used in this document it is referring to the indirect tax zone as defined in subsection 195-1 of the GST Act.

To view your bills sign in to My Telstra using your Telstra IDIf youve forgotten your Telstra ID username or password you can reset it.

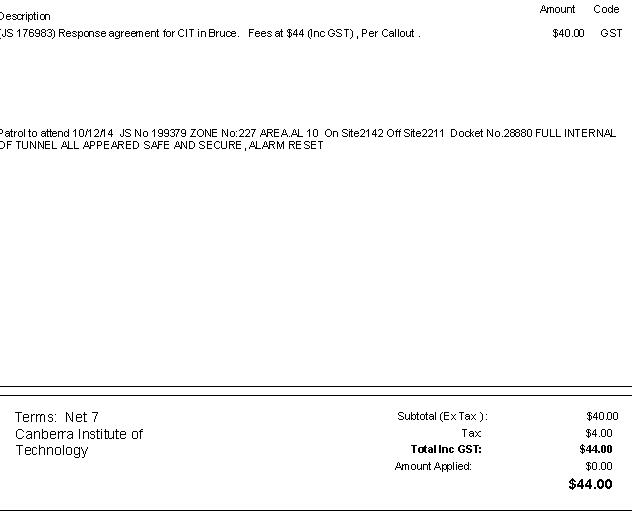

Goods And Services Tax Gst Policy Canberra Institute Of Technology

All About Gst E Invoice Generation System On Portal With Applicability

Gst Tax Invoice Ruling Addisondvk

Gst Tax Invoice Ruling Addisondvk

New Process To Cancel Gst Registration Certificate From 1 2 19 ज एसट र Analysis Legal Advice Online Training

Gst Tax Invoice Format In Excel Word Pdf And Pdf Invoice Format In Excel Invoice Template Word Invoice Format

Download Excel Format Of Tax Invoice In Gst Gst Invoice Format Gst Invoice Format Download Excel Invoice Format Invoice Format In Excel Invoice Template Word

Gst Input Tax Credit Blocked Credits Taxmann

Updated Faq On Gst Tcs Issued By Cbic ज एसट ट स एस अपड ट Gst News 649 Faq Update Analysis

Budget 2022 The Top Five Gst Changes

Gst Tax Invoice Ruling Addisondvk

Gst Invoice Format Rules Download Sample Tax Invoice Indiafilings

Gst Tax Invoice Ruling Addisondvk

Gst E Invoicing Business Invoicing Goods And Services

Gst Tax Invoice Ruling Addisondvk

Gst Update Prevention Severe Indirect Tax

Opinion Tax Deduction At Source Tds Under Gst And Its Refund

How To Revise Invoice In Gst Important Things To Know